Big Beautiful Bill, China, and the End of US Renewables (for now)

The One, Big, Beautiful Bill Act's removal of renewable tax credits almost certainly cements China's victory in the clean energy race.

Despite Skepticism, Clean Energy Still Takes Hit

On Thursday (7/3), Hakeem Jeffries’ eight-hour magic minute speech attempted to redirect the One, Big, Beautiful Bill Act (OBBBA) from passing through the House of Representatives—the last step before the president’s desk (and final approval).

House Speaker Mike Johnson pulled multiple all-nighters to convince the remaining republican holdouts to flip, with some suggestions that Trump offered signed merchandise as a final push attempt. The bill passed, despite being at a tight margin (214-218).

Large bills often come with much scrutiny, given their severity and fine-print details that can be easily missed. But President Trump’s new 940-page bill is disapproved by 64% of registered voters, and critics name the bill’s Medicaid funding cuts (affecting low-income & disabled individuals, rural hospitals), food stamp restrictions (SNAP costs), increased defense spending, and clean energy tax credit cuts to piling on unnecessary national debt.

This article focuses on the clean energy reductions included in the bill, and specifically how solar, wind, and electric vehicle initiatives (from the Inflation Reduction Act) will be reversed by the OBBBA.

Acknowledgments – The (Dropped) Excise Tax

The Senate eliminated their excise tax on Chinese-supplied wind and solar facilities in the US.

The budget reconciliation would tax projects based on material sourcing limits from Foreign Entities of Concern (FEOC)—specifically, projects that use a large amount of materials from competing countries like China, Russia, and Iran.

The tax would target all solar and wind projects that began service after December 31st, 2027, in addition to the removal of all tax credits.

Carried over from the IRA, the tax addressed domestic manufacturing and sought to prevent competing countries from contributing to US development and increasing market share—specifically including China.

The tax was added in the weekend leading up to (6/30) and quickly taken out after it attracted increased public disapproval.

However, FEOC restrictions still apply to all solar and wind projects in the current bill.

“America-First Energy” and the End of the Green New Deal

Entering office for the second time, President Trump’s focus was to create (at least a sense of) energy independence in the US. It sounds great on paper, but a literal definition of this independence isn’t clear: the US has been a net total exporter of energy sources (combining crude oil, petroleum products, liquified natural gas, and coal) since 2019, while reducing its total energy imports every year since 2007.

Even still, Canada was the source of the US’ largest imports, delivering over 60% of the US’ crude oil and nearly all of their natural gas supply in 2023, and also proved that the US is very dependent on other countries—Canada’s heavier oil is best suited for the US’ older refineries anyways.

So Trump’s insistence on fostering energy independence, if not a slight at Canada and the Middle East, was to increase domestic energy production. However, Trump wasn’t focusing on oil and gas, but rather on the lofty clean energy incentives outlined in the Inflation Reduction Act of 2022.

Clean Energy: Solar, Wind, & BEVs

The idea was that solar, wind, and electric vehicles were too enabled by tax credits, weren’t independently profitable, and didn’t provide the consistent levels of generation that traditional power plants provided. Additionally, because of China’s firm grasp on the renewable materials market, the United States has been heavily importing from—and relying on—Chinese imports for solar PV, wind systems, and batteries for new clean energy development.

Engulfed by the tariff-war and trade disputes with China in the past six months, Trump is actively seeking to stand up against a country that has dominated United States imports across all sectors for decades. The FEOC rules, initially constructed by President Biden, are now expanded to include all companies operated by the Chinese government.

But despite the cuts to solar and wind, the OBBBA intends to refocus clean energy funding on more efficient sources of generation, including battery energy storage systems (BESS) and carbon capture. Both relatively new technologies, the two systems are long-term projects that have higher potential for reducing carbon imprint: carbon capture by inserting carbon dioxide beneath the earth’s surface for multipurpose use (sequestration or oil recovery), and battery storage by storing energy for peak demand days. The OBBBA is also lighter on nuclear, geothermal, and hydropower energy, despite headlining that credits on all forms of clean energy were neutralized.

Battery Electric Vehicles (BEVs)

In another significant component of the bill, Trump also ends the point of sale $7,500 federal tax credit for battery electric vehicles (BEVs) of qualifying purchasers, which will take effect on September 30th, 2025. Given that most electric vehicles are still considered to be luxury, with an average price of $57,734 from Kelley Blue Book, the tax credit was widely used to reduce costs and increase BEV uptake. Market supply and demand laws suggest that manufacturers will be forced to lower the upfront costs of BEVs, therefore preserving their customer base, but many have lost significant money on the electric models regardless, like Ford and General Motors.

Specifically, the bill rolls out all aforementioned clean energy initiatives by 2035, with tax credit-qualifying solar and wind projects first needing to be initiated before July 5, 2026, or fully constructed by December 31st, 2027. The widened FEOC laws now also apply to solar and wind projects, making it extremely difficult for developers to move forward without any use of Chinese materials.

The Full List of Incentive Changes

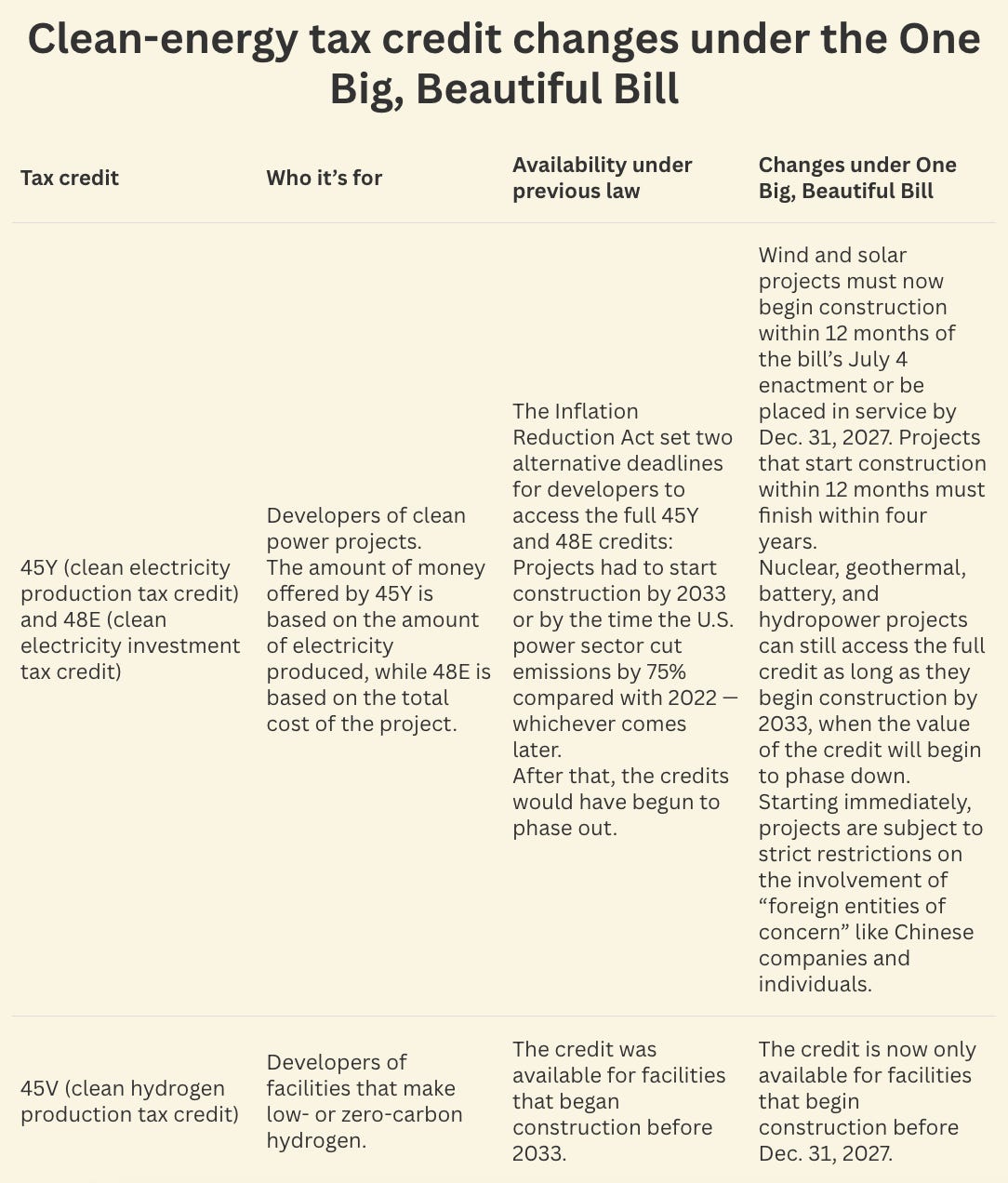

Below are the clean energy tax cuts outlined in Chapter 5 of the One Big Beautiful Bill Act, with this information provided by Canary Media:

Desperate Short-Term Need, but Severe Long-Term Consequences

Despite the One Big Beautiful Bill Act receiving widespread criticism for its clean energy cuts, the US requires capable generation fast, and solar and wind projects alone haven’t been cutting it. Fossil fuels still accounts for 60.0% of electricity generation (as of 2023), and this dependency is needed more than ever.

Wind turbines are difficult to repair and can be a negative public good to nearby communities, based on their looming presence. Solar panels take up significant amounts of land and impose a similar negative externality in public areas, especially when constructed in mass numbers.

But ultimately, both sources have been too dependent on tax credits without proving to be profitable without them, and power plant generation remains the most efficient source of fuel to support the exponentially high (and growing) usage demand from data centers and cryptocurrency mining.

The bill’s solution to refocus development on coal, natural gas, and petroleum power plants may be necessary to sustain this unprecedented growth—but it theoretically would have been nice to keep bringing solar and wind projects online as well.

By ceasing the tax credits for EVs and solar, wind, hydropower, and geothermal energy, the United States concedes the clean energy battle to China almost entirely. It will be nearly impossible to make up China’s market share concentration based on their own solar, wind, and battery investments that are now decades ahead of the US’ domestic efforts, and ending the US’ short-term trade on Chinese renewable materials may only necessitate its dependence on China in the future.